5 Simple Techniques For Personal Loans Canada

Table of ContentsTop Guidelines Of Personal Loans CanadaThe smart Trick of Personal Loans Canada That Nobody is DiscussingThe 45-Second Trick For Personal Loans CanadaNot known Incorrect Statements About Personal Loans Canada The Greatest Guide To Personal Loans Canada

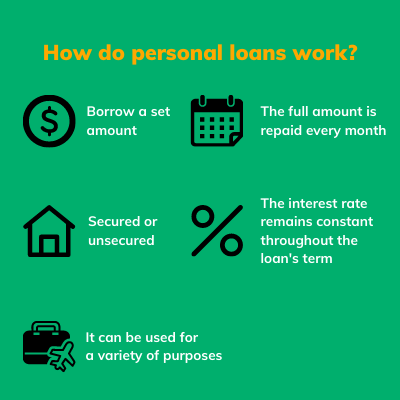

Let's study what a personal loan in fact is (and what it's not), the reasons individuals use them, and how you can cover those crazy emergency situation costs without handling the problem of financial debt. An individual car loan is a round figure of money you can borrow for. well, nearly anything., but that's technically not a personal lending (Personal Loans Canada). Individual financings are made through an actual financial institutionlike a financial institution, credit score union or on-line lender.

Let's take an appearance at each so you can recognize exactly just how they workand why you do not require one. Ever before.

Personal Loans Canada - The Facts

Shocked? That's fine. Regardless of how good your credit rating is, you'll still need to pay rate of interest on many personal fundings. There's constantly a rate to spend for borrowing cash. Protected personal financings, on the various other hand, have some type of collateral to "safeguard" the funding, like a watercraft, jewelry or RVjust among others.

You can likewise obtain a safeguarded individual financing utilizing your automobile as collateral. However that's a dangerous relocation! You don't desire your primary setting of transport to and from job getting repo'ed since you're still spending for last year's kitchen remodel. Count on us, there's absolutely nothing secure regarding safe fundings.

Just because the payments are foreseeable, it doesn't imply this is an excellent offer. Personal Loans Canada. Like we stated previously, you're basically ensured to pay interest on an individual loan. Just do the mathematics: You'll finish up paying means extra in the future by securing a finance than if you would certainly just paid with money

Our Personal Loans Canada Ideas

And you're the fish hanging on a line. An installment financing is a personal lending you pay back in taken care of installments in time (typically when a month) till it's paid in complete - Personal Loans Canada. And don't miss this: You have to repay the original financing amount prior to you can borrow anything else

Don't be mistaken: This isn't the same as a credit scores card. With personal lines of credit scores, you're paying rate of interest on the loaneven if you pay on time.

This one obtains us riled up. Because these companies prey on individuals that can not pay their bills. Technically, these are temporary loans that provide you your paycheck in advancement.

Top Guidelines Of Personal Loans Canada

Since points get actual untidy real quick when you miss a settlement. Those lenders will certainly come after your wonderful grandmother that guaranteed the car loan for you. Oh, and you ought to never ever cosign a funding for anyone else either!

All you're actually doing is using brand-new debt to pay off old financial read the article debt (and extending your loan term). Companies recognize that toowhich is specifically why so numerous of them use you loan consolidation lendings.

And it begins with not obtaining any kind of even more cash. Whether you're assuming of taking out an individual finance to cover that kitchen area remodel or your overwhelming credit report card costs. Taking out debt to pay for points isn't the means to go.

The 8-Second Trick For Personal Loans Canada

The ideal thing you can do for your monetary future is leave that buy-now-pay-later attitude and state no to those spending impulses. And if you're thinking about an individual funding to cover an emergency situation, we obtain it. Obtaining cash to pay for an emergency just rises the tension and challenge of the scenario.